Content

Expenses from operations must be reported by their nature and, optionally, by function (IFRS). Expenses by nature relate to the type of expense or the source of expense such as salaries, insurance, advertising, travel and entertainment, supplies expense, depreciation and amortization, and utilities expense, to name a few. The statement for Toulon Ltd. is an example of reporting expenses by nature. The amounts of these other comprehensive income adjustments (positive or negative) are not included in the corporation's net income, income statement, or retained earnings.

The condensed or single-step formats make the statement simple to complete and keeps sensitive information out of the hands of competitive companies, but provides little in the way of analytical detail. In some circumstances, companies combine the income statement and statement of comprehensive income into one statement or it will be included as footnotes. However, a company with other comprehensive income will typically file this form separately. The statement of comprehensive income is not required if a company does not meet the criteria to classify income as comprehensive income. Net income is what you have left of gross revenue after subtracting expenses and costs of your goods sold, whereas comprehensive income combines net income with various unrealized gains not reported as earned income.

OCI

It accompanies an organization’s income statement, and is intended to present a more complete picture of the financial results of a business. It is typically presented after the income statement within the financial statements package, and sometimes on the same page as the income statement. Comprehensive income is the total of a company's net income, as recorded on the income statement, and unrealized income (or "other comprehensive income") that is not included on an income statement but is recorded in the statement of comprehensive income. The statement of comprehensive income displays both net income details and other comprehensive income details.

Also, this statement introduces complexity to the financial reporting package that can be annoying for the accounting department producing it, and provides information that some users have complained is excessively esoteric to be overly useful. By adding this statement to the financial statement package, investors have a more detailed view of revenue and expense items that will be realized in the future. This extra information can provide some clues as to the financial results that a business will report at a later date, though only a portion of it. At the end of the financial period, return inwards account is concurrently closed down to trading account as afore indicated above.

Disadvantages of the Statement of Comprehensive Income

Closing inventory at the end of every financial period becomes the opening inventory in the proceeding financial period be it of raw materials, WIP or finished goods. As discussed earlier the determination of its monetary value is through inventory valuation process whereby IAS-2 and FIFO method applies. That is, the value is on the basis of cost or net realizable market price, whichever is lower.

On the other hand, it’s also important to understand limitations of the statement of comprehensive income. It reports all income and expense items that are not recorded in the Income statement but affect Owners’ Equity. The Statement of Comprehensive Income, commonly known as the Profit and Loss Statement, tells us whether an organization generates a profit or a loss for a period of time. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Statement of financial position (balance sheet)

For stress-free accounting, contact to our certified CPA firm in Chicago for outsourced accounting services Chicago as they are subject matter experts and can help with financial modeling and other related topics. Net gets moved into a company's statement of comprehensive income where adjustments are made for non-owner activities. This statement has several benefits that stakeholders can take advantage of, but it also has a few limitations that might restrict how truly useful it can be. While they're not the same, they do factor into each other, so your company needs to be tracking both of them in the same periods to get a clear picture of your financial status that stakeholders want to see.

Financial statements show earnings per share as well as net profit, giving an indication of how much money the investor might make. Using net profit alone might deflate earnings per share, so it’s important to include all income in this calculation. Other comprehensive income is an account that appears on the income statement. NOTE – in the Wellbourn example presented above, on the https://www.bookstime.com/articles/statement-of-comprehensive-income, the account is listed as Unrealized gain from FVOCI investment.

Disadvantages of Statement of Comprehensive Income

Comprehensive income excludes owner-caused changes in equity, such as the sale of stock or purchase of Treasury shares. About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers. The P&L, Balance sheet, and Cash flow statements are three interrelated parts. The Statement of Comprehensive Income is included in the Financial Reporting module of the CFA Level 1 Curriculum.

- Additionally, comparing a company’s performance with industry standards helps to assess the risks of not achieving goals compared to competitor companies in the same industry sector.

- Unrealized income might come from nonowner sources, including gains due to foreign currency transactions, fluctuating asset values, and hedge financial instruments, among other financial events.

- Though this statement has some predictive value, it makes no indication of the timing for when revenue and expense items will be realized in the future.

- Another area where the income statement falls short is the fact that it cannot predict a firm’s future success.

- Be mindful of the difference in account names as that can be confusing to students.

Income excluded from the income statement is reported under "accumulated other comprehensive income" of the shareholders' equity section. Similarly, it highlights both the present and accrued expenses – expenses that the company is yet to pay. But if there’s a large unrealized gain or loss embedded in the assets or liabilities of a company, it could affect the future viability of the company drastically. By adding other comprehensive with your net from your normal income statement, you will get your company's comprehensive income. Just make sure that both the net and OCI cover the same period of time. At the end of the financial period, return outwards account is concurrently closed down to trading account as afore indicated above.

Contents of the Statement of Comprehensive Income

Likewise, investments do poorly over the long run, comprehensive financial statements might signal it's time to change the investment strategy. A corporation’s comprehensive income includes both net income and unrealized income. For example, it might https://www.bookstime.com/ relate to gains and losses from foreign currency transactions, or unrealized gains from hedge financial instruments. At times, companies accrue gains or losses due to fluctuations in asset value, which wouldn’t be recognized under net income.

What is statement of comprehensive income ACCA?

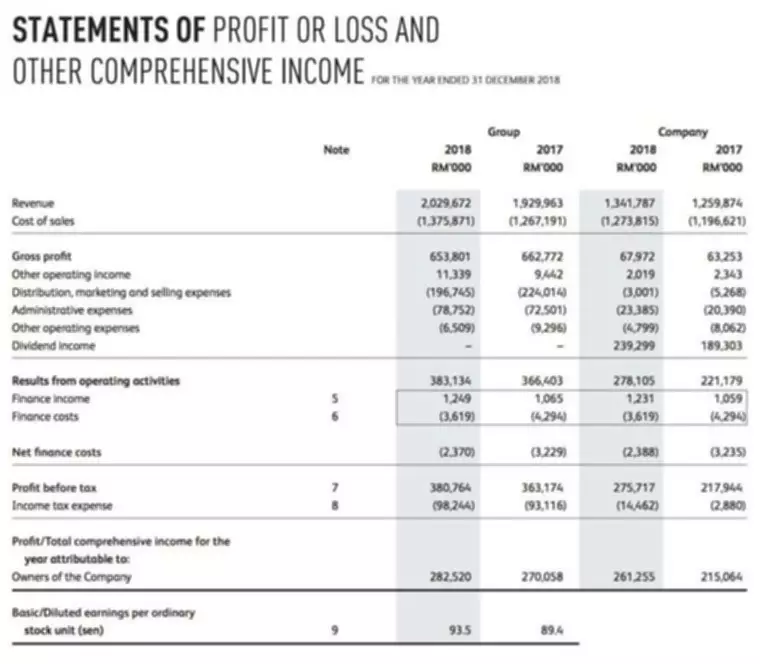

The purpose of the statement of profit or loss and other comprehensive income (PLOCI) is to show an entity's financial performance in a way that is useful to a wide range of users. The statement should be classified and aggregated in a manner that makes it understandable and comparable.