Because of high consumer demand and the lower capital offset requirements, mortgage lenders are able to offer buy-to-let finance at typically lower interest rates than commercial mortgages. Lenders typically do thorough extreme due diligence on a proposed commercial mortgage loan prior to funding the loan. Such due diligence often includes a site tour, a financial review, and due diligence on the property's sponsor and legal borrowing entity.

- At the same time, clients approach the bank with a need and meet with the loan officer to find out if they qualify for financing.

- You can apply for a line of credit well in advance of any financial needs, and it may provide a quick fix for cash flow gaps or working capital needs.

- For example, a loan to buy a restaurant, along with the bulding, is an example of a commercial loan.

- Like consumer loan officers, commercial lenders look for stability and assets before granting a loan to a business owner.

A traditional lender will have a more formal, lengthier application process whereas an online lender may have a quicker process, where they just need to verify your income. In any case, to qualify for a commercial loan, expect that your business will need higher revenues, a longer track record and/or greater collateral than you would need to take out a small business loan. Few people know about the USDA commercial loan program, but the program is terrific.

Other Services

Traditional lenders and the SBA have tougher standards and will expect to see a full range of documents including your financial statements, tax returns and business plan. With an online lender, you may be able to qualify by proving you meet their minimum revenue requirement. Below is a list of the major types of lenders who make commercial real estate loans. They are listed in order, which the cheapest, most desirable lenders at the top. Hard money bridge loans are typically fixed rate loans with rates as low as 8% (in California), 9% to 10% nationwide, and sometimes as high as 12% to 13% on riskier deals. Please forgive me if this first section sounds like a sales pitch; but I have an important concept to convey.

- If you are a new business, don’t worry if some of this information isn’t available yet.

- This means they do not require any collateral or security as a part of the agreement.

- We are happy to provide personalized recommendations for the type of loan that would suit your needs best.

At the end of the loan’s term, a business will usually convert inventory or accounts receivable to cash in order to pay back the loan. Use a loan calculator to help you understand how different commercial loan terms will impact your business and to find the best option. If you aren’t using collateral to secure your loan, your credit history will be an important part of getting approved. If you have a good credit history and you've paid off your debts in the past, there is a higher chance you will get approval for your loan faster than if you apply with bad credit history.

The lender could be willing to set a more flexible payment schedule, that matches when you think you’ll best be able to repay, an option that might not be available for a smaller loan. While the lender will charge interest on your loan, whatever you end up paying in interest will be tax deductible. Equipment loans — You can use these loans to buy an expensive piece of equipment or other assets for your business. With equipment loans, you may be able to secure the loan just using the asset itself so your business will not need to put up any other forms of collateral. If your proposed collateral is your inventory of, say, 100 completed surfboards, you would apply for an inventory loan to either a bank or a specialty finance company.

WHAT ARE THE DIFFERENT TYPES OF COMMERCIAL LOANS?

The lender wants to see that you consistently earn money so that they feel confident that you will be able to make your payment each month. Many times, a commercial loan will be secured by the item it was used to purchase. For example, if you need a business loan to buy heavy machinery or a building, the machine or building serves as collateral. Because there is a physical object that the lender can seize in the event of a default, you may qualify for lower rates or more favorable terms than you would with a personal loan. The second most important class of lender making commercial real estate loans these days is the conduit or CMBS lender. A conduit makes commercial real estate loans according to a very precise cookie-cutter.

Once you pay back what you've borrowed, your full credit line is once again available for use. Although conventional commercial real estate bank loans are fairly straightforward, their terms can vary since no government agency oversees these loans. Terms may vary depending on property type and the lending institution. Conventional commercial loans act as a primary lien against a financed property, and the time frame is usually medium- to long-term. In many ways, these loans offer a straightforward way to finance commercial buildings. If you’re worried about qualifying for a regular commercial loan, another option is to try applying through the SBA program.

Commercial mortgage

Working capital loans give you funds to cover operating costs for your business. This will allow you to overcome seasonal cash flow or accounts receivable gaps, take advantage of unique opportunities, or cover additional project expenses. They are normally short term, unsecured loans - meaning there’s nothing used as collateral on the loan. For this reason, they tend to have a shorter payoff and higher interest rates than other options. When considering needs and the potential risks involved with any commercial loan, it's vital to have a full view of your company's overall health. This means keeping both your own credit score and your business's current financial status in mind.

Loan losses at US banks hit $19bn as borrowers feel rate rise pain - Financial Times

Loan losses at US banks hit $19bn as borrowers feel rate rise pain.

Posted: Wed, 09 Aug 2023 04:01:07 GMT [source]

Before making any decisions on any of these types of commercial loans, there are some key things to consider. Having these answers ready can help make the overall process more efficient—and get you the funds you need faster. Whether you're ready to purchase your own space or refinance the one you have, business real estate loans can help you get the funds you need for your physical location. Your business might use term loans to address debt restructuring, building improvements, working capital, equipment purchases or staff expansion. Knowing these four main types of commercial loans available can help you facilitate a more productive conversation with a lending specialist when you're ready to seek financing.

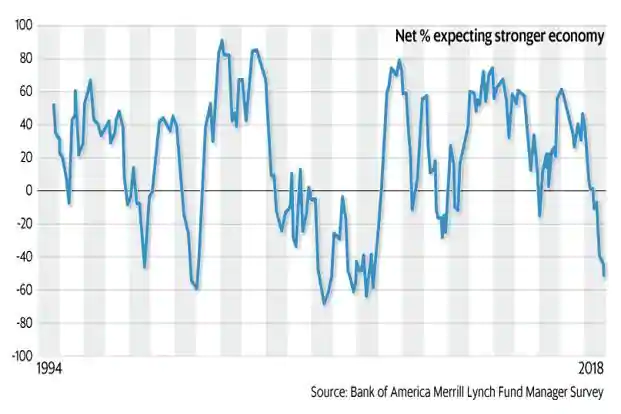

How to Get Financial Help For a Small Business in a Bad Economy

SBA 7(a) loans - Can be used for construction, renovation, or buying land or buildings. SBA 7(a) loans allow you to borrow up to $5,000,000 for 25 years for commercial real estate, or 10 years for other purposes with either a fixed or variable interest rate. With a line of credit, you typically only pay interest on the amount you draw. Many lenders even offer interest-only payments to help ease cash flow crunches.

A commercial loan can be a great way to provide some financial relief to your small business. As debt-based funding, commercial loans are very helpful with this financial assistance. The type of commercial loan you decide to pursue for your business will often depend on what you need it for. The good news is that there are several different types of commercial loans you can explore. So, if you need to purchase new office space or fund the next step in your business strategy, there will likely be one that suits your needs.

Real estate loans can be used for purchasing things such as residential properties or cooperatives, undeveloped land, or forests. In some states, oil and mineral rights are considered real property and can be bought with real estate loans. Your business’s needs will determine the right loan for your financial situation. Commercial loans can also be bundled with other financial products to provide the borrower with more options. These might include personal lines of credit, receivables factoring, and asset-based lending.

You might work an entire lifetime as a commercial mortgage banker and never successfully close a commercial real estate loan with a life company. In addition, the conduits have been stealing much of the market from life companies because they offer much higher leverage. A commercial loan is a debt-based funding arrangement between a business and a financial institution such as a bank. It is typically used to fund major commercial loan meaning capital expenditures and/or cover operational costs that the company may otherwise be unable to afford. Expensive upfront costs and regulatory hurdles often prevent small businesses from having direct access to bond and equity markets for financing. This means that, not unlike individual consumers, smaller businesses must rely on other lending products, such as lines of credit, unsecured loans or term loans.

The overall commercial loan had a 93% growth in its portfolio value from FY17 to FY21. Whether it’s a firm’s business banking division or its commercial real estate lending team underwriting the exposure, commercial loan structure is often guided by predetermined credit policies. If you want to move forward with certain operational costs or fund new capital expenditures, a commercial loan can help. There are also a few different types, such as equipment financing, bridge loans, inventory financing, and others. The most important thing to keep in mind is what you actually need the loan for.

It also prevents consumers from making poor judgments, such as selecting an unsuitable lender, selecting an inconvenient term, or borrowing more than they require. For example, one type of secured commercial loan is a mortgage on a building. The borrower pledges the building as collateral to the lender to make the loan payments. The borrower has an option to repay or refinance during the term of the loan.

What Terms Do Conventional Commercial Real Estate Loans Offer?

Woodsboro Bank is happy to sit down with you to learn more about your specific situation so that we can offer solutions that are tailored to you. Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website. As mentioned, it’s always a good idea to verify that a lender is trustworthy with a site like the BBB or Trustpilot. Before borrowing from an online lender, however, make sure the lender is registered with an appropriate agency and has a good reputation on a trusted review site such as the Better Business Bureau (BBB).

Default risks surge in US office metro markets - fDi Intelligence

Default risks surge in US office metro markets.

Posted: Wed, 09 Aug 2023 10:00:00 GMT [source]

Short-term loans are useful for restocking inventory, meeting payroll, handling an emergency repair, and a variety of other daily operating costs. Commercial business loans provide funding for business expenses, such as equipment or real estate. When you borrow, you’ll typically get the full amount upfront and pay it back over a set period of time, often at a fixed interest rate. Buy-to-let mortgages share similarities with both commercial and residential mortgages.